Lenders have two forms of exposure when funding a client with a federal tax liability: (1) levy and (2) funding in second position behind a federal tax lien (tortious conversion of assets). Exposure to levy or conversion jeopardizes a lender’s collateral, but it doesn’t have to mean the end of the funding relationship.

Levy v. Lien

A levy is essentially the same thing as a seizure – it takes an asset. The most common levies attach to bank accounts or receivables, but the IRS can also seize inventory, equipment, real property, etc.

A federal tax lien does not take or seize anything. Instead, the federal tax lien provides notice to third parties of the government’s secured interest in the property and establishes priority relative to other secured interests.

How Levies Work

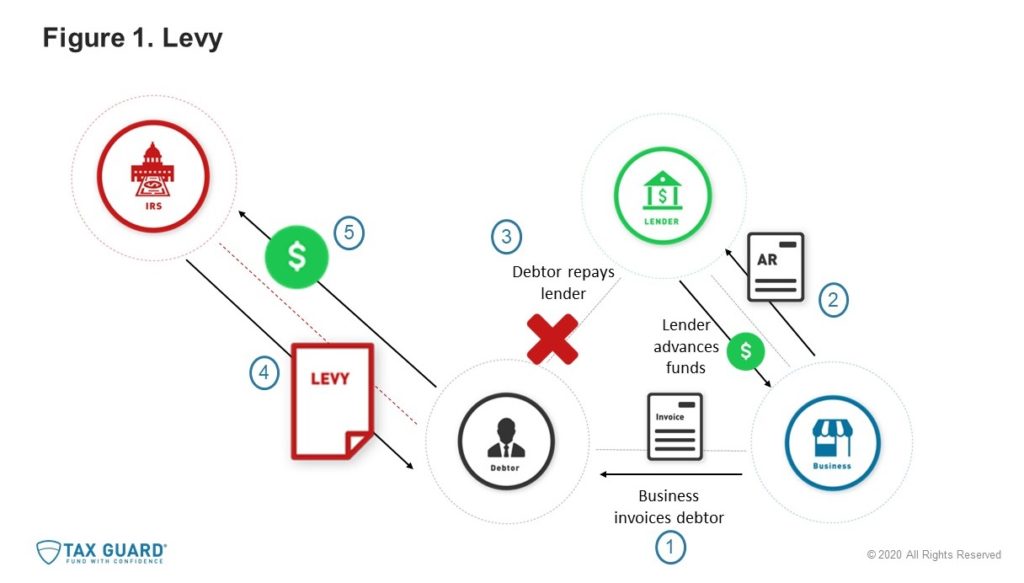

Levies on accounts receivable are the most common way for a lender to get burnt by the IRS. When the IRS issues a levy on receivables, it disrupts the typical asset-based transaction in the following manner (as illustrated in Figure 1. Levy below):

- A business completes the agreed upon work and invoices its customer, the debtor.

- The business presents the invoice to its lender, who either advances funds using the invoice as collateral or purchases the invoice.

- Generally, the debtor will pay the invoiced amount directly to the lender based on the terms of the invoice, e.g., net 30, so that the lender is recouped on its advance.

- The IRS sends a levy to the debtor – a letter instructing the debtor to send any outstanding funds owed to the business to the IRS, instead of the business (or lender).

- The IRS effectively intercepts the funds. The lender is unable to recuperate its advances and loses money.

- Alternatively, a levy may be issued to a bank. Any funds in the business’s accounts at the time of the levy are held by the bank and remitted to the IRS 21 days after processing of the levy.

There are two important points to consider regarding levies:

- The IRS must issue a Final Notice of Intent to Levy prior to any seizure of assets, including levies on bank accounts and receivables. That final notice usually takes the form of Letter 1058 or LT11.

- There is no requirement for the IRS to file a federal tax lien before it levies bank accounts and accounts receivable. The IRS can issue levies without a federal tax lien in place.

There is no requirement for the IRS to file a federal tax lien before it levies bank accounts and accounts receivable. The IRS can issue levies without a federal tax lien in place.

How Conversion Works

Funding in second position behind a federal tax lien exposes a lender to tortious conversion of assets, also known as “clawback” or “disgorgement.” A typical scenario is outlined below.

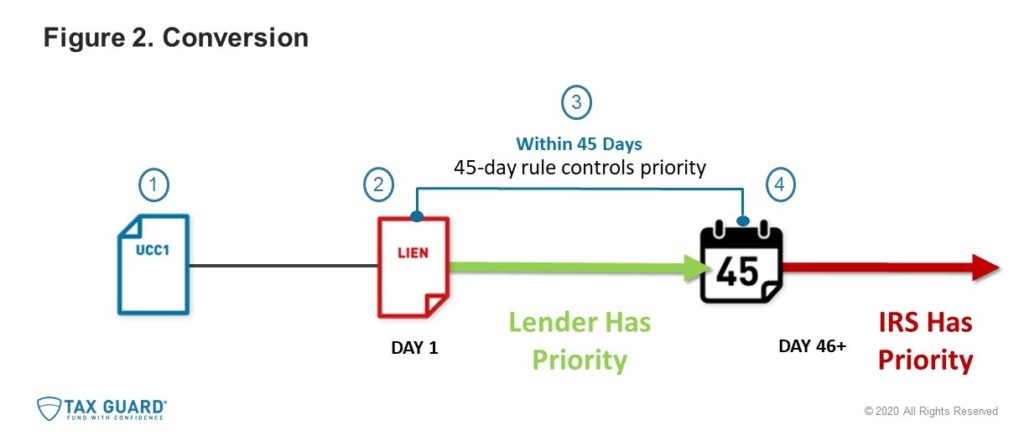

- A lender files its UCC-1 securing its interest in the receivables and begins funding.

- On Day 1, the IRS files a federal tax lien. The IRS has what some refer to as a “super priority” – meaning the IRS’s federal tax lien automatically moves into first position relative to other secured parties. However, the IRS does not move into first position immediately.

- Per the 45-day rule, the lender maintains priority relative to the IRS for 45 days from the date the lien is filed (or until the lender obtains “actual knowledge” of the lien, whichever occurs first). For a detailed explanation of the 45-day rule, including the black letter law as well as how the IRS works in practice, please view our video and/or whitepaper on the subject.

- On Day 46, once 45 days pass (or the lender acquires actual knowledge in the interim), the federal tax lien takes priority. The lender is now funding in second position to the IRS. Any funds advanced and collected on or after the 46th day expose the lender to tortious conversion of assets, or conversion.

How Do We Avoid Exposure?

Generally, we protect the business, protect the lender, and preserve the funding relationship through a three-step process:

- Pending installment agreement,

- Installment agreement reduced to writing, and

- Subordination of federal tax lien.

For more information on the resolution process, please see our post Am You Safe to Fund? The Three Stages of Resolution or contact us.