December 17, 2020

In late November, the Small Business Administration, under court order, released the complete list of businesses that participated in the federal government’s Paycheck Protection Program (PPP) loans. Tax Guard’s data science team compared that list against the businesses in our database for which we have compliance information from November 2019 through November 2020 (13 months). They tracked deposit information for businesses who received a PPP loan (recipients) and compared it to that made by businesses who did not receive a PPP loan (non-recipients). Whether a business makes its required federal tax deposits is an early indicator of a business’s health and a lender’s risk/exposure to the IRS. The PPP loans had a positive, but short-lived effect on federal tax deposits.

The past 13 months can be roughly divided into four periods or trends, which is evident from the deposit data:

| Description | Timeframe | Economic Environment |

| Normal/Pre-Pandemic | Nov. 2019 through Feb. 2020 | Stable/Normal |

| Peak Pandemic/Shutdown | March through April 2020 | Steep Decline/Weakening |

| PPP Loan | May through Sept. 2020 | Recovery |

| Post-PPP Loan | Oct. through Nov. 2020 | Decline/Weakening |

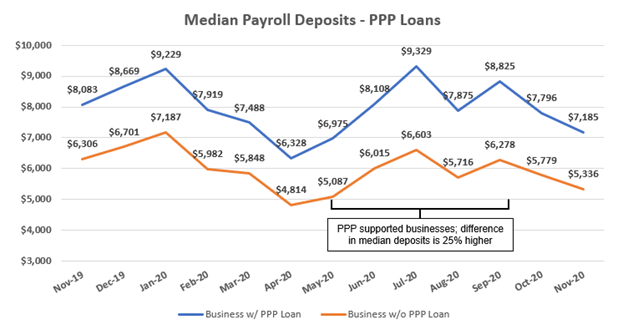

Median Deposits

Although recipients had larger median deposits than non-recipients, the general trends were almost identical for both groups. Additionally, the general trends coincide with the steep decline, narrow/limited recovery, and current decline of the economy in general.

- Median deposits for both recipients and non-recipients dropped sharply during the peak pandemic/shutdown months of March through April 2020.

- Median deposits for both recipients and non-recipients rebounded during the economic recovery from May through September 2020, so much so that recipients’ median deposits for September 2020 surpassed the previous high in January 2020 ($9,329 in September 2020 vs. $9,229 in January 2020), indicating that the PPP funds were deployed towards current deposits.

- Although the deposits for both recipients and non-recipients both increased from May through September 2020, the gap in deposits between recipients and non-recipients grew an additional 25% during the PPP loan program and economic recovery. Recipients likely had more employees and/or were better positioned to make deposits than non-recipients, but the increased gap would seem to indicate the PPP money had some additional positive effect on median deposits beyond the general economic recovery.

- Unfortunately, the median deposits for both recipients and non-recipients are trending downward again, which is not surprising since the PPP loans have been exhausted. The median deposit is almost $1,000 less for both recipients and non-recipients, respectively, when comparing November 2020 to November 2019.

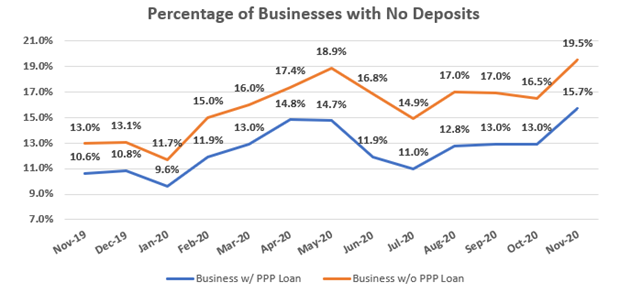

Zero Deposits

Tax Guard’s data science team also tracks the number of businesses monitored each month that do not make any deposits. Generally, there are two reasons a business would make no deposits in a given month – the business has no payroll/employees, or the business is not making the required deposits. As with median deposits, the “no deposit” data trends coincide with those of the general economy.

- The number of businesses making no deposits increased sharply from March through May 2020, declined slightly during the middle of the PPP loan and economic recovery phase (June and July 2020), and are, unfortunately, increasing again.

- The percentage of businesses making no deposits has increased 50% year over year (19.5% in November 2020 vs. 13% in November 2019) – a substantial portion of the additional 6.5% represents missing deposits, which will soon turn into liabilities once the associated returns are filed.

- The seasonally adjusted unemployment rate is 6.7% as of November 2020, which follows seven straight months of declines after peaking at 14.7% in May 2020. In our assessment, the increase in the number of businesses making no deposits has more to do with (non)compliance issues than eliminating payroll at this point.

Liabilities

Approximately 18% of the recipients also have federal tax liabilities, which is in line with what Tax Guard has observed over the past 10 years – approximately 1 in 5 businesses owes money to the IRS. We compared the amounts owed in April 2020 to the amounts owed in November 2020, essentially pre- and post-PPP program. Federal tax liabilities increased for 23% of recipients, decreased for 29% of recipients, and stayed the same for 48% of recipients. For three-fourths of recipients with federal tax liabilities, they either tread water or the situation worsened, another indicator that the PPP funds were a short-term fix for many small to mid-size businesses.

Tax Guard’s Assessment

- The PPP loan program had a positive, but short-lived impact on federal tax deposits. Median deposits briefly returned to pre-pandemic levels for about three months, before declining again. Although the percentage of businesses making no deposits decreased in June and July 2020, the percentage of businesses making no deposits is now at its highest level in years.

- Utilization of Tax Guard’s reporting and monitoring will be especially important to factors and asset-based lenders in the foreseeable future. Whereas median deposits are declining and the percentage of businesses making no deposits has increased 50 percent year over year, there will be a tremendous number of new tax liabilities assessed once the (missing) returns are filed.

- Tax Guard’s resolution team can solve these issues before they threaten your collateral, but only if they are first identified by our reporting and monitoring services.