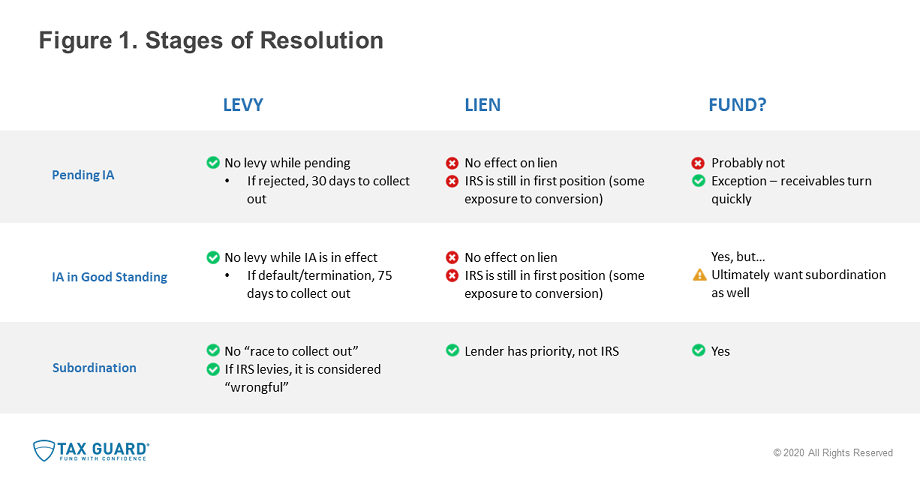

A federal tax liability, without a proper resolution in place, can easily disrupt a funding relationship. Generally, there are three stages to the resolution process: pending Installment Agreement, Installment Agreement in good standing, and the subordination of federal tax lien. At each stage, your exposure to the Internal Revenue Service (IRS), whether levy and/or tortious conversion of assets, differs. The following is some guidance for determining when it is safe to fund.

Stage One: Pending Installment Agreement

Generally, when a business submits a proposal for an installment agreement, the IRS must acknowledge the proposal as “pending” until a final determination can be made. The “pending” status affords lenders some limited protections.

- While the proposal is “pending,” the IRS cannot levy bank accounts or receivables.

- A “pending” Installment Agreement has no effect on a federal tax lien – the lender still has exposure to conversion from funding in second position behind the IRS.

- In the worst case scenario, the IRS rejects the proposal. The business has a 30-day window to file an appeal. While the appeal is pending, the IRS cannot levy bank accounts or receivables.

- Once the lender learns of the rejected proposal, the lender can continue its efforts to collect without interference from the IRS, which effectively gives the lender a “head start” of up to 30 days before the IRS can levy, depending upon when the lender learns of the rejection.

Is a lender safe to fund with only a “pending” Installment Agreement? Probably not. The opportunity to appeal a rejected Installment Agreement proposal provides the lender with a 30-day “head start” on collecting any outstanding receivables before the IRS can levy those same receivables. Whereas most receivables take longer than 30 days to collect, the lender would have some unnecessary exposure to levy.

Depending on a lender’s tolerance for risk, there may be limited exceptions to the general rule that a lender should not fund with only a pending Installment Agreement in place. For example, if the receivables have a history of turning in 10 to 15 days (transportation, medical, etc.), then the 30-day “head start” may be sufficient to protect the lender.

Stage Two: Installment Agreement in Good Standing

Once the proposed Installment Agreement is accepted and reduced to writing by the IRS, there are additional protections (so long as the agreement is in good standing).

- The IRS cannot levy bank accounts or receivables.

- There is no effect on the federal tax lien – the lender still has exposure to conversion from funding in second position behind the IRS.

- In the worst case scenario, the business defaults the agreement, the IRS issues a “Notice of Intent to Terminate” the agreement, and the business fails to correct the default. It takes the IRS 75 days to work through the default/termination process and return the case to the Collections Division. During that time, the IRS cannot levy the business’s assets.

- Once the lender learns of the IRS’s “Notice of Intent to Terminate,” the lender can continue its efforts to collect without interference from the IRS, which effectively gives the lender a “head start” of up to 75 days before the IRS can levy, depending upon when the lender learns of the “Notice of Intent to Terminate.”

Practice Pointer. There are three possible actions/nonactions that can default an agreement.

- The business accrues a new liability and/or does not make its current federal tax deposits in full and on time.

- There are one or more unfiled returns.

- There are one or more missed installment agreement payments.

Is a lender safe to fund with only an Installment Agreement? Probably, at least in the short-term. Most receivables are collected within 30 to 45 days. The Notice of Intent to Terminate an agreement provides the lender with 75-day “head start” to collect any outstanding receivables before the IRS can levy those receivables. As such, the lender is protected from levy and it is probably safe to fund with just an Installment Agreement in place on a short-term basis, e.g., waiting for a subordination of federal tax lien. However, if the lender is going to fund in second position behind the IRS, the lender needs to confirm the Installment Agreement is in good standing and monitor the situation regularly.

Stage Three: Subordination of Federal Tax Lien

Is a lender safe to fund with an Installment Agreement and subordination of federal tax lien? Absolutely. Unlike the first two steps in the resolution process, the subordination of federal tax lien does not directly prevent levy. Instead, the subordination of federal tax lien addresses priority – the document allows the lender’s secured interest to move ahead of the IRS’s federal tax lien. The Installment Agreement prevents levy; the subordination addresses priority and eliminates a lender’s exposure to tortious conversion of assets based on funding in second position behind the IRS.

The two documents work together so that the lender does not find itself in a race to collect out with the IRS (assuming the lender funds with a subordination in place). Even if the Installment Agreement and subordination ultimately terminate, the lender still has priority to the receivables funded while the subordination was in effect, which allows the lender to take as long as necessary to collect those receivables without interference from the IRS.

Practice Pointer. A prerequisite or requirement for a subordination of federal tax lien is an Installment Agreement in good standing.

Practice Pointer. Because an Installment Agreement in good standing is a requirement for a subordination, termination of the Installment Agreement could lead to termination of the subordination as well. As such, even with a subordination in place, it is imperative that the lender monitor the underlying agreement on an ongoing basis.